- The Euro remains on the defensive against the US Dollar.

- Stocks in Europe open with marked losses on Thursday.

- EUR/USD deflates to weekly lows near 1.0530.

- The USD Index (DXY) extends the upside and approaches 107.00.

The Euro (EUR) is extending its vulnerability against the US Dollar (USD), resulting in EUR/USD shedding further ground to weekly lows around 1.0540 following Europe’s opening bell on Thursday.

The Greenback is regaining further balance after extra gains on Wednesday, leading the USD Index (DXY) to the proximity of the key hurdle at 107.00. The daily advance in the Dollar appears once again bolstered by higher US yields in the belly and the long end of the curve.

Regarding monetary policy, there is a growing consensus among market participants that the Federal Reserve (Fed) will maintain its current stance of keeping interest rates unchanged at the meeting on November 1. This view has been reinforced by remarks made by Fed Chair Jerome Powell in his recent speech at the Economic Club of New York on October 19.

Investors are contemplating the possibility of the European Central Bank (ECB) discontinuing its policy of tightening, even though inflation levels have exceeded the bank’s target and concerns are emerging regarding the risk of an economic slowdown or stagflation in the Eurozone. On this, the ECB is widely anticipated to leave its interest rates unchanged at its meeting later in the session. This would be the first pause after ten consecutive interest-rate hikes.

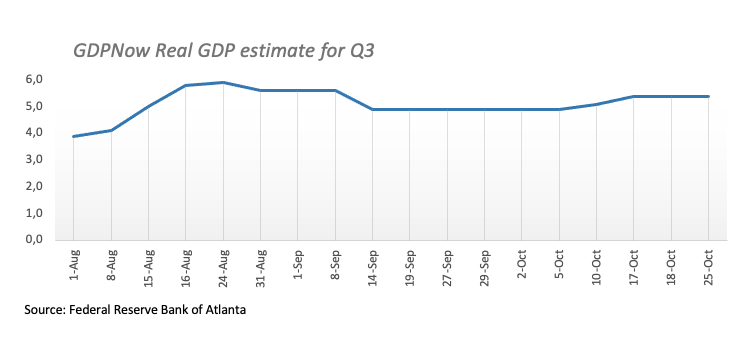

Data-wise, in the US, the flash Q3 GDP Growth Rate will be at the center of the debate, seconded by weekly Initial Jobless Claims, Pending Home Sales, Durable Goods Orders and preliminary Goods Trade Balance.

Daily digest market movers: Euro loses grip, retargeting 1.0500

- The EUR’s decline picks up extra pace against the USD on Thursday.

- US and German yields trade in a mixed fashion early in the European session.

- A 25 bps rate hike by the Fed remains on the table for December.

- The ECB is seen entering a (protracted?) pause at its meeting on Thursday.

- Geopolitical concerns in the Middle East remain steady.

- The move above 150.00 in USD/JPY reignites intervention talk.

- Investors’ attention will also be on Lagarde’s press conference.

- US GDP figures are expected to show further resilience of the economy.

Technical Analysis: Euro still risks deeper pullback near term

EUR/USD extends the bearish note to fresh weekly lows and shifts its attention to a potential visit to the 1.0500 neighbourhood.

If the selling trend continues, immediate support may be located near the October 13 low of 1.0495, followed by the 2023 low of 1.0448 seen on October 3 before hitting the round level of 1.0400. If this zone is crossed, the pair may continue to fall towards the lows of 1.0290 (November 30, 2022) and 1.0222 (November 21, 2022).

If bulls retake control, EUR/USD will find initial resistance around the Wednesday’s top of 1.0694, which looks underpinned by the vicinity of the temporary 55-day Simple Moving Average (SMA). The breakout of this zone reveals the September 12 high of 1.0767, which precedes the significant 200-day SMA at 1.0813. Once this level is cleared, it might signal a further push towards the August 30 peaks of 1.0945, prior to the psychological milestone of 1.1000. If the rising trend continues, the August 10 peak of 1.1064 might be challenged, seconded by the July 27 high of 1.1149, and possibly even the 2023 top of 1.1275 seen on July 18.

As long as the EUR/USD continues below the 200-day SMA, the pair may face persistent negative pressure.