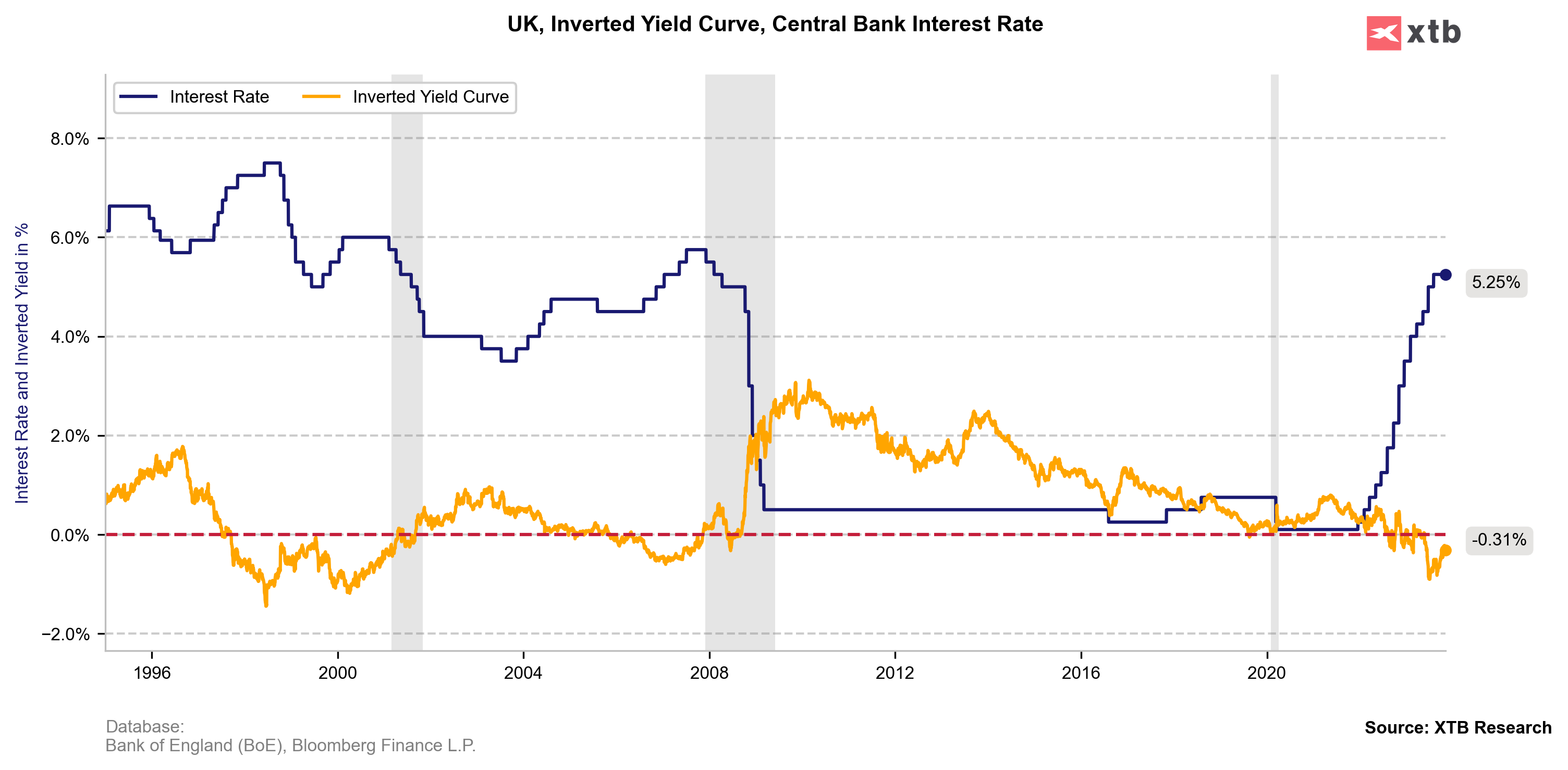

Bank of England announced its latest monetary policy decision today at 12:00 pm GMT. The consensus of the markets was in favor of the BoE keeping interest rates unchanged at 5.25% for the second consecutive time. The actual decision turned out to be in line with these expectations.

Bank of England’s Monetary Policy Committee (MPC) voted by a majority of 6–3 to maintain the Bank Rate at 5.25%, with a minority favoring a hike to 5.5%. The Committee’s projections, based on market expectations, suggest the Bank Rate will hold around 5.25% until Q3 2024 before gradually declining to 4.25% by the end of 2026. This is higher for longer outlook that previously expected by the markets, which probably triggered bullish reaction on GBP currency.

- Market rates imply less BoE tightening than August, show bank rate at 5.3% in Q4 2023, 5.1% in Q4 2024, 4.5% in Q4 2025 (August: 5.8% in Q4 2023, 5.9% in Q4 2024, 5.0% in Q4 2025)

- BoE: We estimate wage growth 6.75% yy in Q4 2023 (August: 6%), Q4 2024 4.25% (August: 3.5%); Q4 2025 2.75% (August: 2.5%)

- BoE estimates GDP in 2023 +0.5% (August forecast: +0.5%), 2024 0% (August +0.5%), 2025 +0.25% (August: +0.25%), based on market rates

- BoE estimates unemployment rate 4.3% in q4 2023% (August: 4.1%); q4 2024 4.7% (August: 4.5%); q4 2025 5.0% (August: 4.8%)

- BoE sees inflation first falling below 2% target in Q4 2025 (August: Q2 2025), based on market rates and modal forecast

The UK’s CPI inflation dropped to 6.7%, below expectations, yet remains above the 2% target. Inflation is anticipated to decline sharply, returning to the target by the end of 2025 and then falling below it. The MPC acknowledges risks of inflation persisting longer than expected, primarily due to wage-price effects and potential rises in energy prices. The MPC’s stance remains restrictive, emphasizing the need to be sufficiently restrictive for a prolonged period to sustainably return inflation to the 2% target. The outlook suggests continued restrictive monetary policy, with further tightening possible if persistent inflationary pressures are observed.

Source: xStation 5