The Bank of England (BoE) intends to keep the interest rates at the current level of 5.25% after today’s meeting. The decision on interest rates will be announced at 12:00 PM GST time. Abstaining from hikes is the baseline scenario reflecting the cautious approach of the Federal Reserve (Fed) and the European Central Bank (ECB). This decision would mean the second consecutive hold following a series of 14 rate hikes since December 2021, aimed at controlling inflation. It’s worth noting that the inflation rate remains significantly above the BoE’s target of 2%, with the latest data indicating a year-on-year increase of 6.7%. Nevertheless, the bank’s policy seems to be heading towards a more considered approach, focused on assessing the economic effects of previous aggressive hikes. BoE bankers indicate the necessity of maintaining rates at a tightened level for the near future.

As seen in the attached graph, the level of interest rates is at the highest level since the 2008 crisis. However, the period leading to the current market status was marked by the most aggressive cycle of tightening for a long time. Bond yields also slowed their growth, suggesting the market’s expected pause or end in monetary tightening.

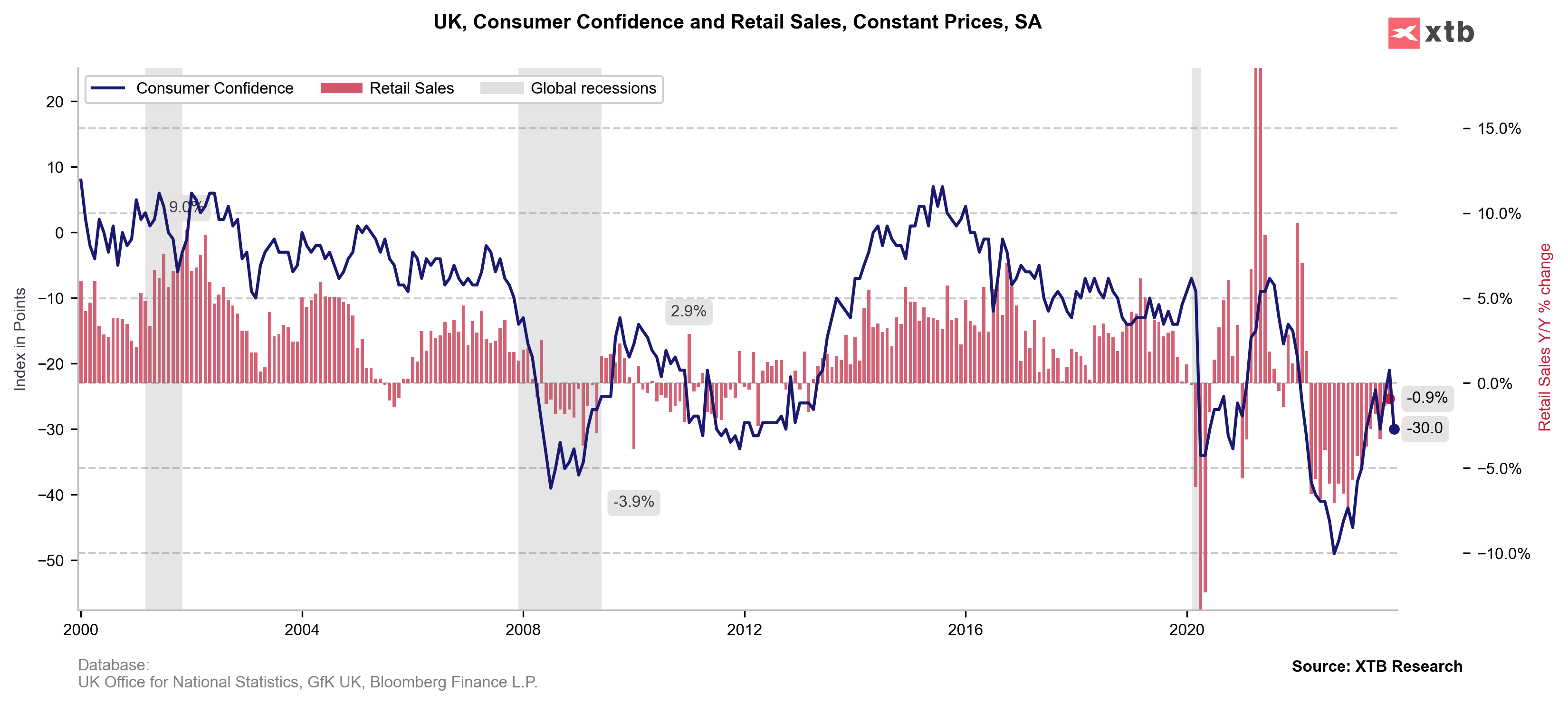

In economic terms, the UK faces many challenges. Inflation, though slightly below BoE’s forecasts, remains high. Economic growth is weak, with projections around 0.5% expansion this and next year. The labor market shows signs of stagnation, and both the manufacturing and service sectors have shrunk. Consumer confidence is falling, and wage growth is still much above the target. Analysts at HSBC suggest that the inflation threat is not entirely suppressed, indicating the need to maintain a vigilant stance in monetary policy. Nevertheless, a change in market sentiments indicates a possible cut in interest rates by the middle of next year.

In real terms, retail sales continue to be weak, and month-to-month year-on-year changes indicate a decline for several months. A weaker market seems to confirm also consumer confidence, which currently is at levels historically indicating a recession.

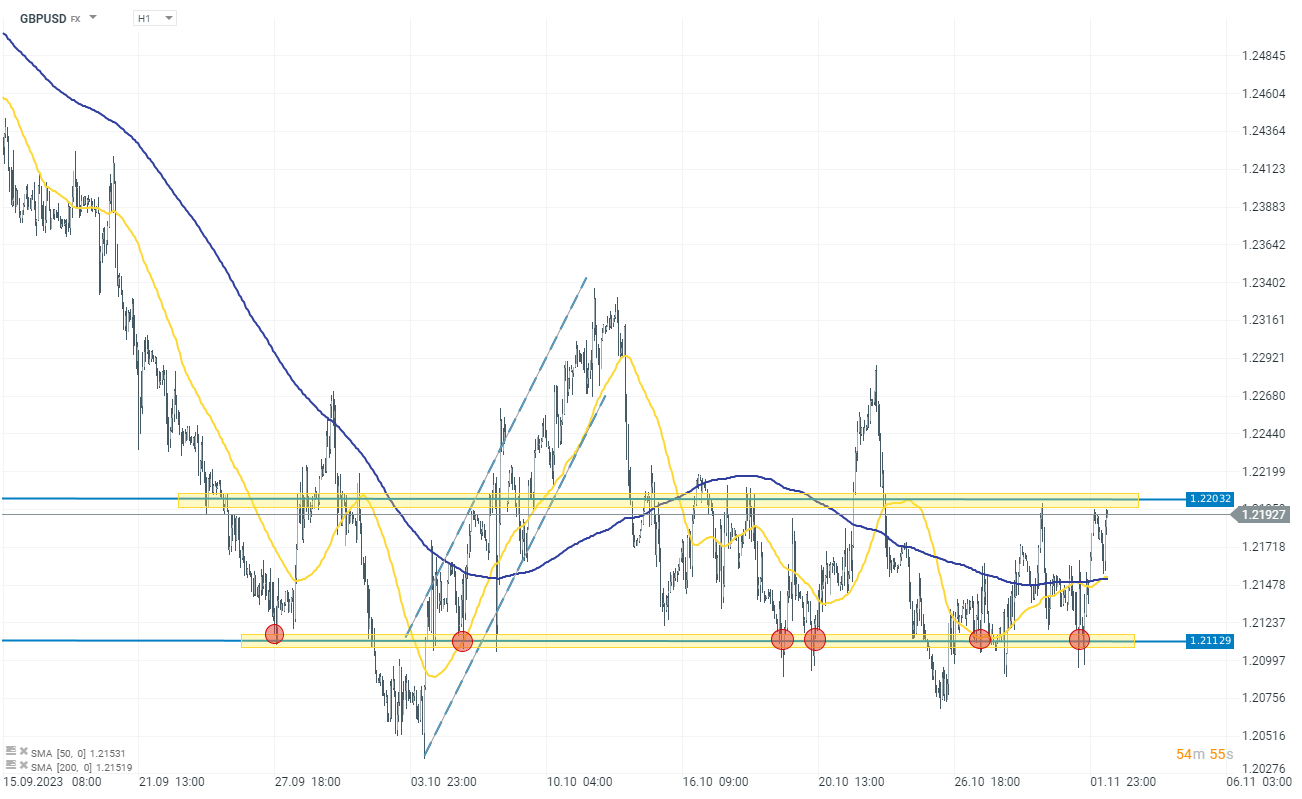

The British pound is one of the weaker currencies today before the BoE’s announcement. Investors might be pricing in the lack of a rate hike at today’s meeting. Looking at the GBPUSD chart, we see today’s rises caused by an even weaker dollar than the pound. GBPUSD is approaching the upper limit of the recent consolidation channel at the level of 1.22. Maintaining rates at the current level and the dovish stance of the BoE could lead to a weakening of the pound and a downward reaction on the chart. Otherwise, we might observe a breakout of the rate from the zone above the level of 1.22. Source: xStation 5