- The Euro picks up extra pace vs. the US Dollar.

- Stocks in Europe open Monday’s session with decent gains.

- EUR/USD prints humble gains near 1.0580.

- The USD Index (DXY) meets initial hurdle near 106.30.

- Final Manufacturing PMIs in the euro zone come next.

- The ISM Manufacturing PMI takes centre stage across the pond.

The Euro (EUR) gains ground against the US Dollar (USD), motivating the EUR/USD to reclaim the area around 1.0590 and advance for the third session in a row following the opening bell on the old continent on Monday.

Meanwhile, the Greenback appears under some pressure, just above the 106.00 hurdle when measured by the USD Index (DXY), and is followed by the continuation of the recovery in the risk complex seen in the latter part of last week.

Furthermore, looking at the fixed-income markets on both sides of the ocean, yields appear directionless so far.

The monetary policy forecast remains unaltered, with investors still expecting the Federal Reserve (Fed) to raise interest rates by 25 bps before the end of the year. Meanwhile, market talks about a probable stalemate in policy changes at the European Central Bank (ECB) continue, despite inflation levels that surpass the bank’s objective and rising fears about a potential recession.

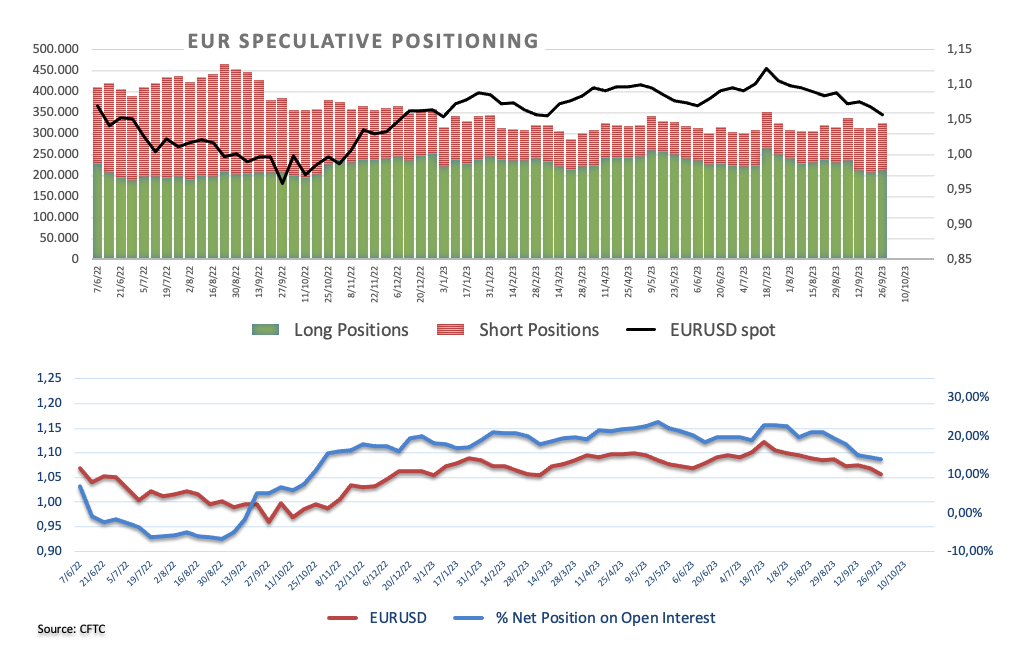

On the positioning front, EUR net longs extended the decline during the week ended on September 26 according to CFTC’s report, falling in line with the sharp sell-off observed in spot in the last few weeks.

In the domestic docket, final Manufacturing PMIs in the euro zone are seconded by the Unemployment Rate in the broader euro bloc.

In the US, all the attention is expected to be on the release of the USM Manufacturing PMI, seconded by Construction Spending, the final S&P Global Manufacturing PMI, and speeches by Philly Fed Patrick Harker (voter, hawk), FOMC Governor Michelle Barr (permanent voter, centrist), and New York Fed John Williams (permanent voter, centrist).

Daily digest market movers: Euro appears supported by risk appetite trends

- The EUR extends the recovery vs. the USD.

- US and German yields show marginal price action so far.

- Markets factor in an extra rate hike by the Fed before year-end.

- Investors foresee an impasse at the ECB’s tightening campaign.

- Chinese PMIs came in mixed for the month of September.

- FX intervention fears remain well and sound around USD/JPY.

Technical Analysis: Immediate support emerges at the 1.0490/80 band

EUR/USD looks to consolidate the rebound from last week’s lows around 1.0490.

If the EUR/USD rebound gets more serious, the pair should encounter the next up-barrier at the weekly high of 1.0767 (September 12), before reaching the crucial 200-day SMA at 1.0827. If the pair breaks beyond this level, it may set up a challenge of the transitory 55-day SMA at 1.0843, ahead of the weekly top at 1.0945 (August 30) and the psychological barrier of 1.1000. The surpass of the latter might prompt the pair to test the August peak of 1.1064 (August 10) ahead of the weekly high of 1.1149 (July 27) and the 2023 top of 1.1275. (July 18).

On the downside, the September low of 1.0491 (September 28) emerges as the next support prior to the 2023 low of 1.0481. (January 6).

However, it is critical to remember that as long as the EUR/USD remains below the 200-day SMA, the possibility of more negative pressure exists.