Oil

- WTI drops below $80 per barrel for the first time in 2 months

- Chinese imports increased 3% YoY in October while analysts expected 4.8% YoY drop, signaling that domestic demand in world’s second largest economy is improving

- Chinese oil imports increased 7% MoM in October, following a 13% MoM drop in September

- Chinese oil exports were 5% MoM lower. However, drop is said to be driven primarily by lack of export permits as government remains reluctant to increase export quotas

- Saudi Arabia and Russia remain committed to keeping voluntarily output cuts in place until the end of the year

- US oil production remains above 13 million barrels per day in spite of number of oil rigs dropping below 500.

Number of oil rigs in the United States dropped below 500 but production stays at elevated levels. Source: Bloomberg Finance LP

Number of oil rigs in the United States dropped below 500 but production stays at elevated levels. Source: Bloomberg Finance LP

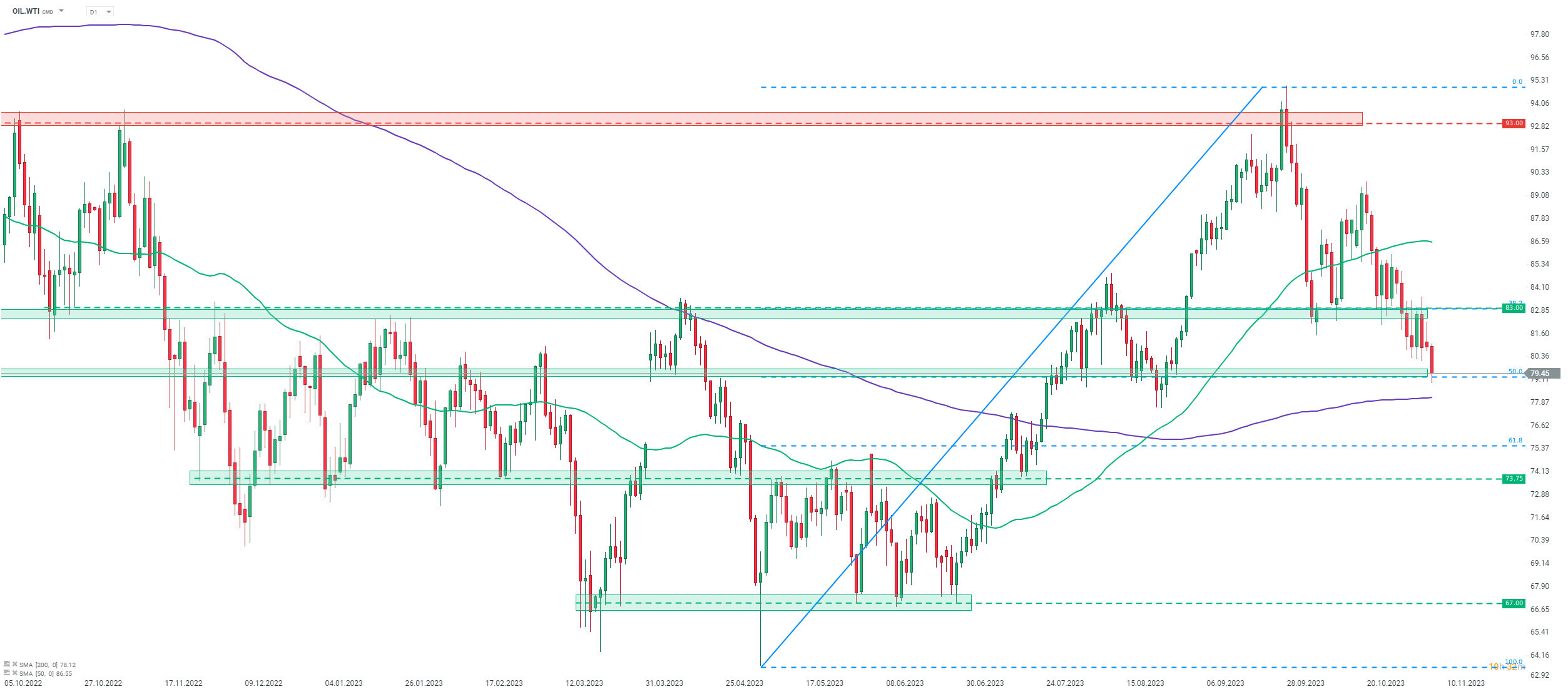

WTI (OIL.WTI) dropped below $80 per barrel for the first time in 2 months and is testing a support zone marked with 50% retracement of the upward move launched in May 2023. Source: xStation5

Gold

- Gold pulls back yields resume climb and feared escalation in the Middle East does not materialize

- While Israel intensified ground operation inside Gaza Strip, no other countries joined the conflict

- US yields halted recent pullback and are trading slightly higher week-to-date. 10-year US yields sit near 4.62% at press time

- FOMC left rates unchanged in-line with expectations and tone of Powell’s presser suggested that there may be no more rate hikes

- RBA decided on a 25 bp rate hike after 4 meetings of keeping rates unchanged. However, this is likely the final hike in the current cycle in Australia

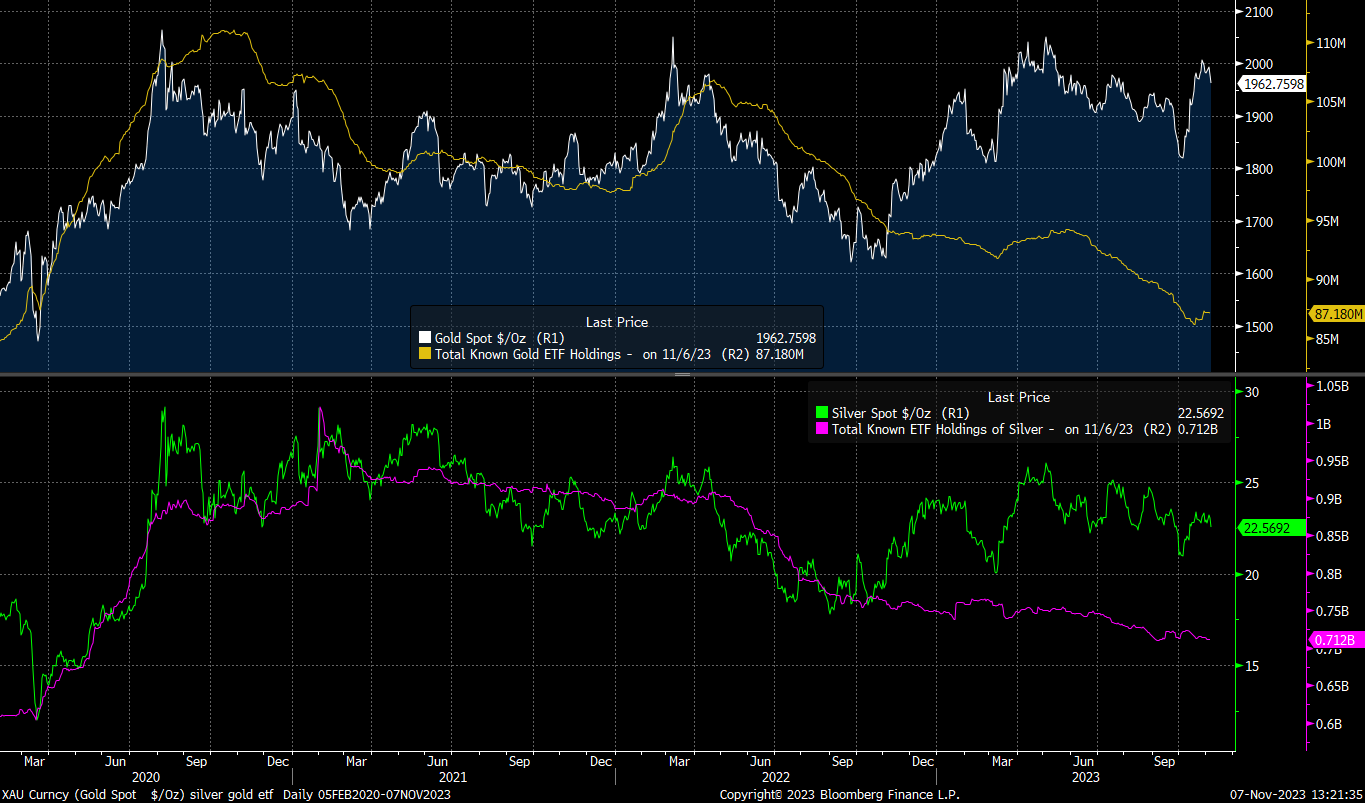

- ETFs increased gold holdings recently while silver holdings declined slightly

Gold prices dropped even as ETFs increased their holdings of gold. Source: Bloomberg Finance LP

Bulls failed to hold GOLD price above $2,000 per ounce and a strong pullback can be spotted this week. Gold dropped back below the price zone marked with 61.8% retracement and is testing the $1,960 area – the lowest level in 2 weeks. Source: xStation5

Natural Gas

- Natural gas launched new week lower as new weather forecast pointed to higher temperatures in the United States

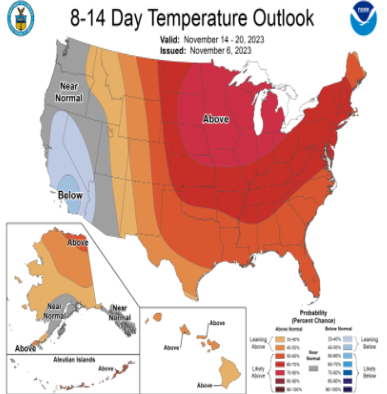

- New forecast points to an above-average temperatures in majority of the United States in the November 14-20, 2023 period, suggesting lower demand for heating

- Natural gas inventories in Europe are 99.6% full, the highest level since 2009

- Inventories in Europe continue to rise even though seasonal peak has passed already

- IEA reports that European gas consumption increased 1% YoY in October, the first year-over-year increase since the beginning of Russian invasion of Ukraine

Temperatures in the United States are expected to be above-average in the near future. Source: Bloomberg Finance LP

European natural gas inventories are the most full since 2009 and are above the 5-year average for the current period of the year. Bloomberg Finance LP

Copper

- Industrial metals launched new week’s trading higher but has given back big part of Monday’s gains on Tuesday

- Monday’s gains were driven by reports that Chinese authorities will issue more debt in order to support economy

- This comes on top of the $1 trillion government bond issuance announcement made last week

- Copper is trading near $8,150 per tonne – around $100 below Monday’s daily high

- Mixed Chinese trade data for September released today is putting pressure on base metal prices

- While copper imports climbed to the highest level of the year, they were still 6.7% YoY lower in January-September period

- Steel products imports were 30.1% YoY lower in January-September period

- Iron ore imports dropped below 100 million tonnes in September for the first time since July

COPPER failed to break above a key mid-term resistance zone in the $8,200 per tonne area, marked with the bearish trendline and previous price reactions. Mixed Chinese trade data for September is putting pressure on industrial metal prices today. Source: xStation5