- US data in focus for investors

- Toyota Motors results support German automotive sector representatives

Overall market situation:

Wednesday’s session on European markets, despite initial gains, is currently showing moderate declines on most stock market benchmarks. It is worth mentioning that, in view of the observance of All Saints’ Day, volatility on European markets may be somewhat lower today. Investors’ attention will turn today towards a number of macro data from the USA, which may elevate volatility in international markets.

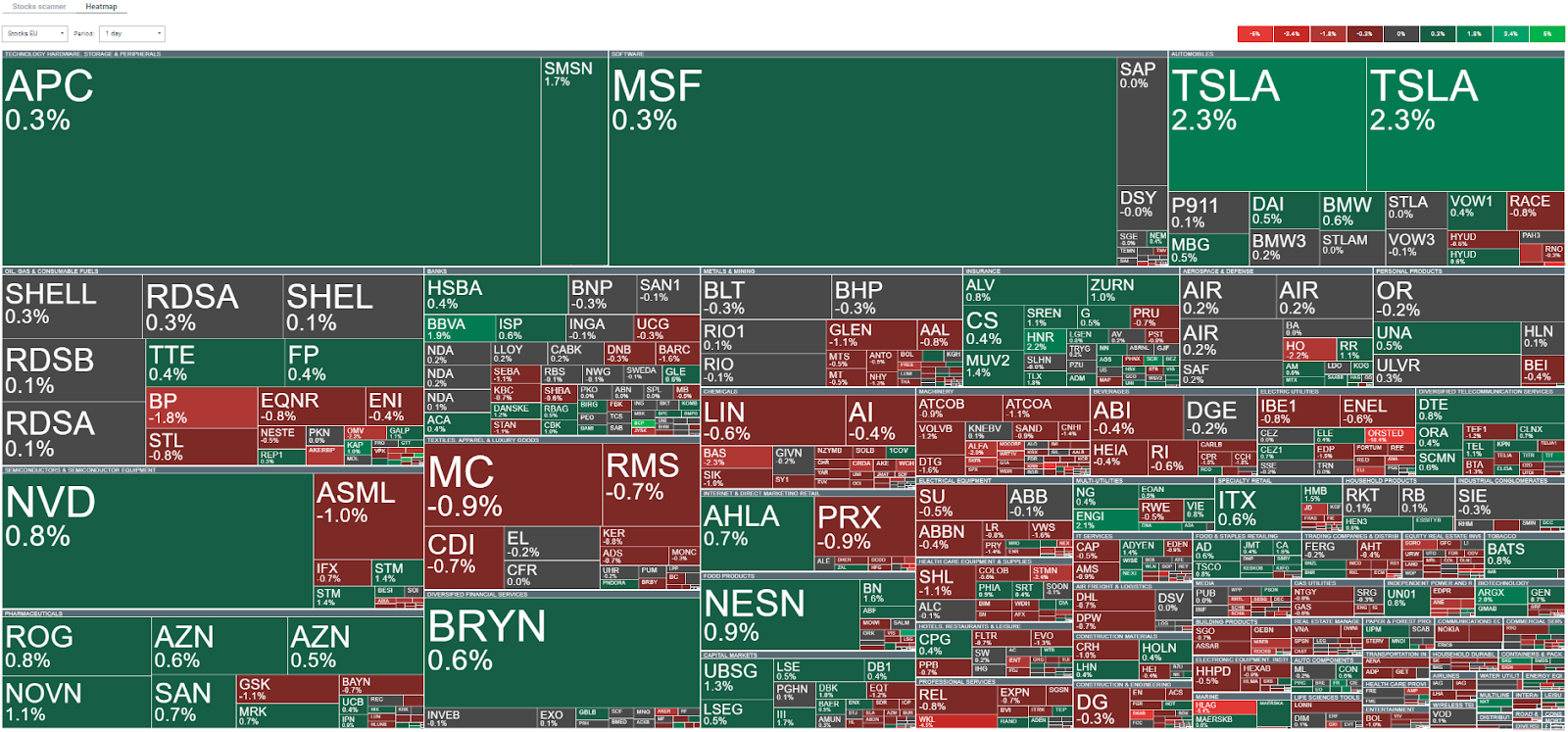

At the moment, companies listed in Europe during Wednesday’s trading session are trading in mixed sentiment. Source: xStation 5

Futures based on the German DE30 are trading nearly 0.25% lower intraday. Today’s session saw an unsuccessful attempt to break above Monday’s maximums. A close of today’s trading above/below this zone could determine future movements quoted on the DE30. Source: xStation 5

News:

October is behind us. On a monthly basis, the shares of Siemens Energy (ENR.DE; -31%) and Sartorius (SRT.DE; -23.47%) recorded serious sell-offs. Rheimtall shares (RHM.DE; +12.87%) were of interest to buyers.

Wind energy-related shares, in particular RWE (RWE.DE) and Nordex (NDX1.DE), are trading under pressure today. At the beginning of the session, the declines quoted on these companies were considerable, but with time the declines were largely erased. The reason for the pressure was Orsted (ORSTED.UK) shares, which lost nearly 18%. The company is closing two major wind power projects in the US. You can read more here.

Better sentiment was also seen among German automotive companies following the publication of better results from Toyota Motor. Mercedez-Benz (MBG.DE) shares gain 0.7% and Volkswagen (VOW1.DE) shares close to 0.6%.

Toyota Motor results:

– Operating income: JPY 1.44 trillion (estimated JPY 1.11 trillion)

– Net income: JPY 1.28 trillion (estimated JPY 904.25 billion)

– Operating income for the year: JPY 4.5 trillion (previously JPY 3 trillion )

Analyst recommendations:

* Volkswagen (VOW1.DE): RBC cuts target price to EUR 140 from EUR 160

* Asos (ASO.UK): Berenberg lowers target price for shares to GBP 6 vs. GBP 7.6.

* Asos (ASO.UK): JP Morgan cuts target price for shares to GBP 3.5 vs. GBP 5.0.

* BP (BP.UK): JP Morgan lowers target price for the stock to GBP 5.5 vs. GBP 6.15.

(Rating drops to ‘underweight’ from previously ‘neutral’)