- Old Continent indices lose ground after surge in recent sessions

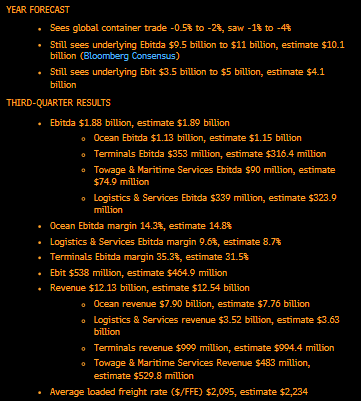

- Maersk negative on earnings forecasts; company cuts 10,000 jobs

- BMW releases better-than-expected quarterly results

Overall market situation:

Friday’s session on the markets brings a negation of the wave of gains on the Old Continent from those still seen in recent sessions. Investors’ attention in the last session of this week will be focused on the reading of the NFP report from the US, which will test optimism assuming that the Fed’s tightening cycle is actually over.

Much of investors’ attention today is drawn to Moller Maersk (MAERSKA.DK) shares, which are losing more than 13%. The company is cutting 10,000 jobs and predicts weakness in global trade through 2026. What’s more, the company says it will hit the lower end of its 2023 forecasts. The buyback program is under review as cost cuts accelerate.

Source: Bloomberg Finance LP

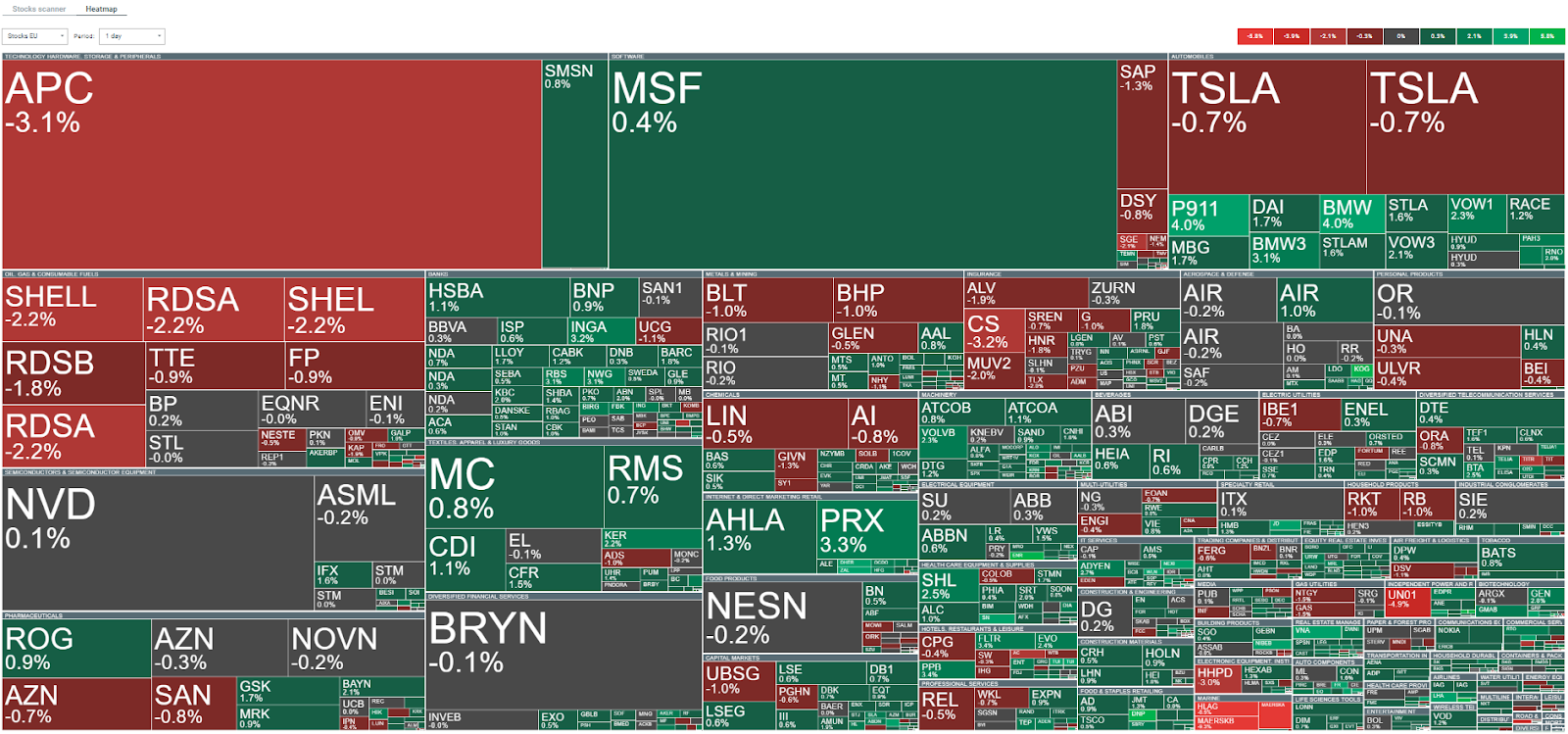

At the moment, companies listed in Europe during Friday’s trading session are trading in slightly better sentiment. However, larger declines are being recorded in the oil companies sector. Source: xStation 5

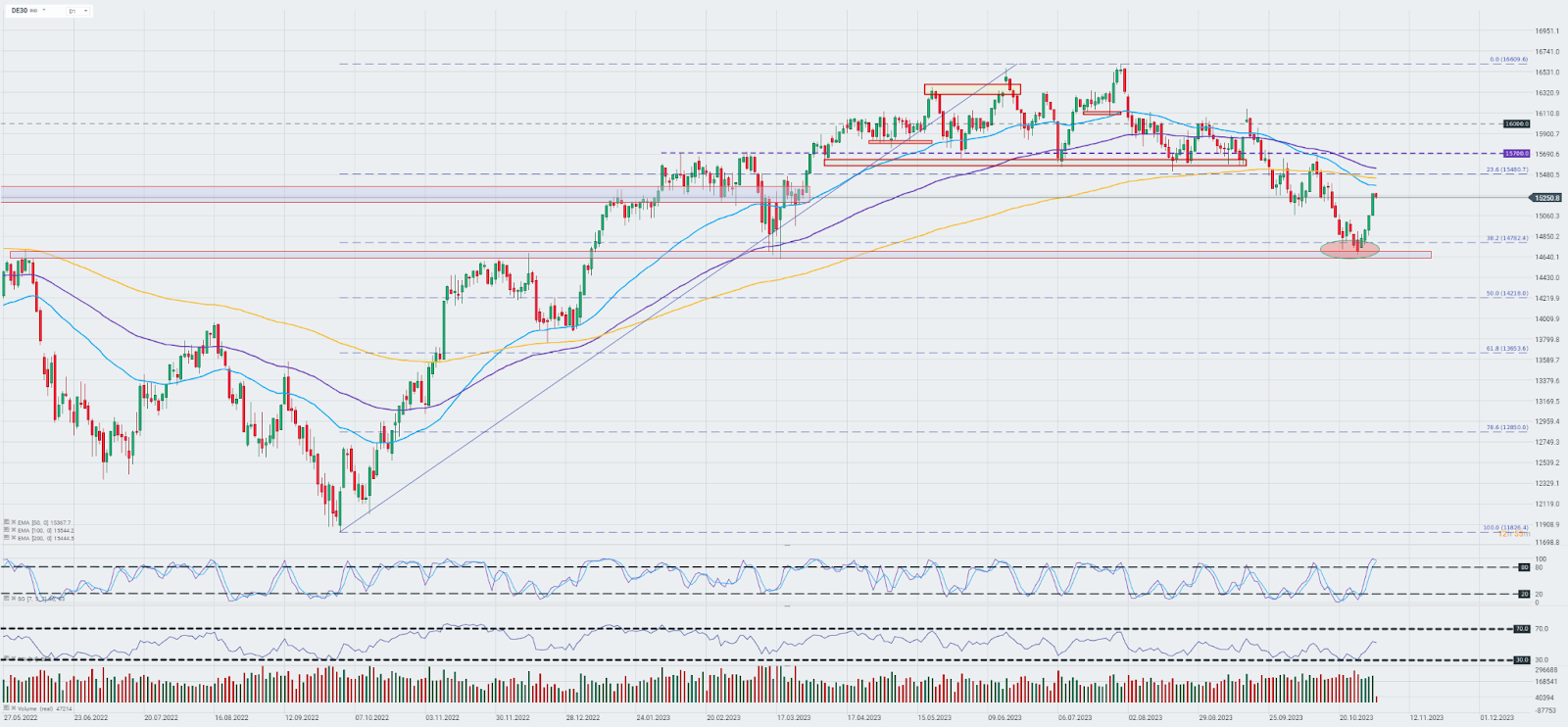

Futures based on the German DE30 are trading nearly 0.23% lower intraday. Source: xStation 5

News:

Shares of Siemens Healthineers (SHL.DE) are gaining nearly 2.8% during today’s session. The company said it is reviewing its diagnostics segment, due to a desire to streamline operations. The review could lead to the sale or spin-off of its in vitro diagnostics business, which tests blood and tissue samples to identify diseases and infections.

Source: xStation5

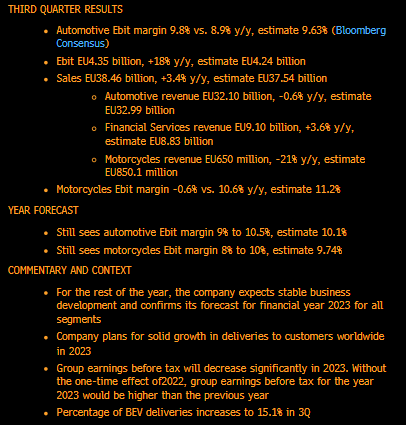

BMW (BMW.DE) shares are up nearly 3.4% following the release of quarterly results. Good sales of EVs helped beat EBIT margin expectations (9.8% y/y vs. 9.63% expected and a reading of 8.9% a year ago). All-electric models accounted for 15.1% of sales in the quarter. You can find more details directly from BMW’s report here.

Detailed company results and comments. Source: Bloomberg Finance LP

Source: xStation

Analyst recommendations:

* Carlsberg (CARLB.DK): HSBC cuts target price to DKK 910 vs. DKK 980.

* Ferrari (RACE.IT): RBC raises target price for the stock to €344 vs. €335.

* Shell Plc (SHELL.NL): Citigroup raises target price for shares to £26.50 vs. £24.

* Kering (KER.FR): Deutsche Bank upgrades the company’s shares to a “buy” rating. Target price rises to EUR 540, previously EUR 510.