As is usually the case for the first Friday of a new month, traders will be offered jobs data from the United States and Canada. Both reports will be released at 1:30 pm BST today, meaning that USDCAD is likely to experience a jump in short-term volatility around that hour.

Of course, the US report will draw more attention. The NFP report for April is expected to show an employment gain of 180k as well as an uptick in the unemployment rate to 3.6%. Wages are expected to increase 0.3% MoM but on an annual basis wage growth is seen staying unchanged at 4.2% YoY. Labour market data has been quite solid as of late and yet it did not discourage Fed from hinting that a pause in rate hike cycle is coming at the next meeting in June. Having said that, the impact of potential NFP beat today may be more short-term and won’t alter rate expectations. When it comes to Canadian data, employment is expected to have increased by 21.5k jobs in April while the unemployment rate also ticked higher, from 5.0 to 5.1%.

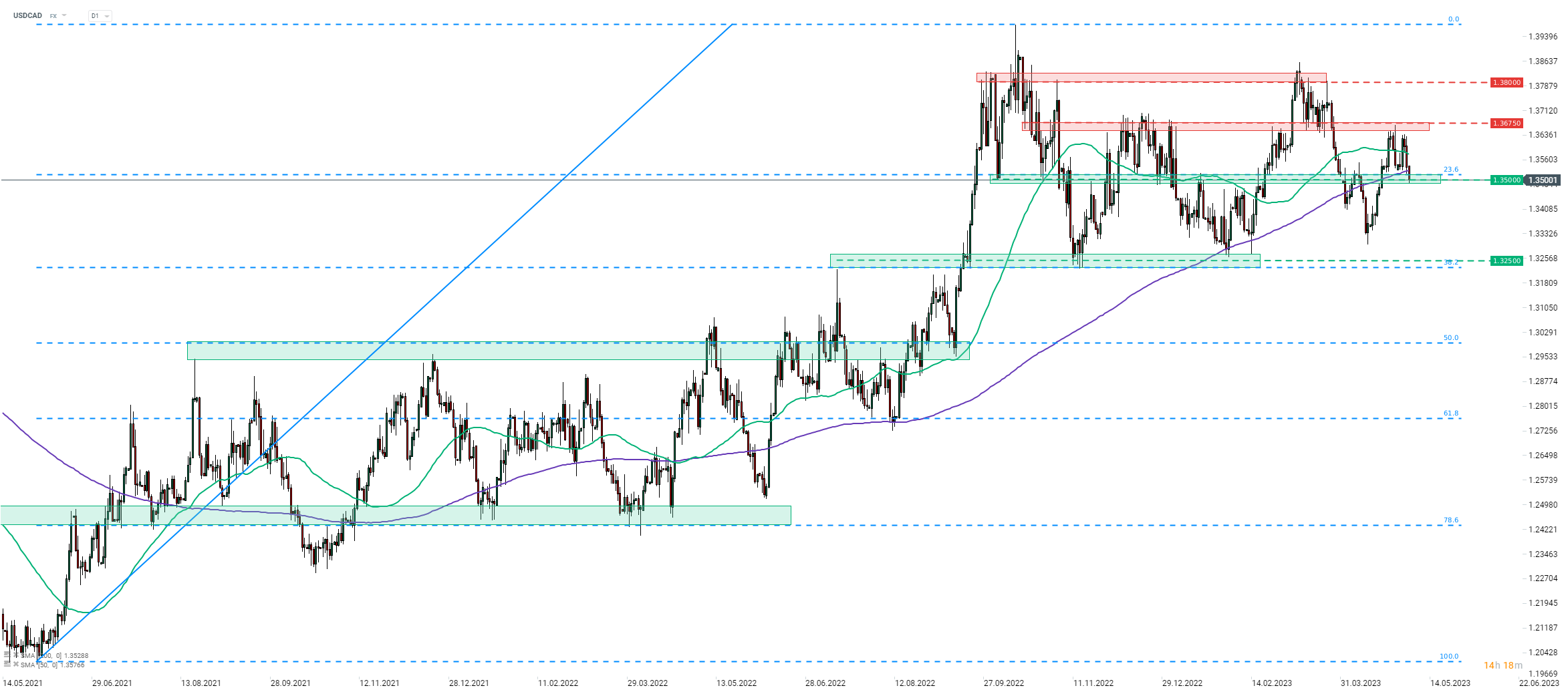

Taking a look at USDCAD chart at D1 interval, we can see that the pair has been trading sideways recently. An attempt to break above the 1.3675 resistance zone was made at the turn of April and May but bulls failed to push the pair above it. Pair started to pull back and is now testing and support zone ranging around 1.35 handle and marked with 200-session moving average (purple line), previous price reactions as well as 23.6% retracement of the upward move launched in June 2021.

Source: xStation5

Source: xStation5